Moving from the African continent to the United States, Ham Serunjogi and Maijid Moujaled were probably far from imagining that their studies in a foreign country would lead to the creation of the largest mobile cross-border money transfer platform in Africa. But they did! Chipper Cash, the solution they developed, is now available in seven African countries, as well as in the US and the UK. We will take to find out more about this power duo that has solved the hassle of transferring money across borders, and revolutionised the FinTech in sub-Saharan Africa.

The decisive meeting of a Ugandan and a Ghanaian

Ham Serunjogi was born and raised in Uganda in a middle-class family. His family owned a farm and his father ran a computer operations company, according to Forbes. The young Serunjogi who was as good at studying as he was at athletics, started swimming competitively before he was 10 years old. In 2010, his parents enrolled him in theAga Khan Academy of Mombasa (AKA Mombasa), Kenya, a high school of excellence that prepares students for a life of leadership and teamwork. At the same time, they encourage him to pursue swimming competitions. He succeeded so à He was selected to join the Ugandan Youth Olympic team and to participate in the Singapore Youth Olympic Games representing his country in 2010.

At the academy, young Ham develops a keen interest in digital technology and is an excellent student. His work which was very well received, enabled him to obtain a scholarship to the United States. In 2012, he moved to Iowa for his university studies at the Grinnell College with a major in economics. There he met the Ghanaian Majid Moujaleda passionate d'who was running a popular coding group at the time. The two young students became fast friends. They combined their respective talents and developed an application that allowed users to send short encrypted voice recordings that self-destructed after playback. This intelligent solution already anticipated the rise of privacy issues in technology. It marke also the beginnings of their entrepreneurial adventure.

During their discussions, the two young inventors talk about various topics including challenges related to cross-border money transfers which many Africans, including themselves, were often confronted with at that time.

Indeed, two years earlier, the young Serunjogi who was in high school at the time, had an experience that left a deep impression on him. His father which was to send money to South Africa as part of its swimming activities, had had all the world to carry out the transaction by bank transfer. He had to leave Uganda and This experience, far from being an isolated one, prompted the duo to think of ways to improve the situation. This experience, far from being isolated and outdated, prompted the duo to think of ways to from facilitate transfers of money in Africa. But before we come to the solution of Serunjogi and MoujaledLet's first get to know the latter.

Like his sidekick, Maijid Moujaled was born and raised in Africa, in Ghana, before moving to the United States of America to study computer science at Grinnell College (2010-2014). Il there is co-founded a mobile application development club, the Grinnell Appdevwhich has been a melting pot of development for several applications for students. Among the latter, G-Liciousan application for the university's catering programme, won the Golden Disc award after its launch on iTunes, Google Play and Microsoft Windows Store.

After their undergraduate studies at GrinnellBoth graduates have worked for major Silicon Valley technology companies. Moujaled worked for Yahoo as a software engineer iOSfrom 2014 to 2015, and for Flickr, where he helped launch an Apple Best of 2014 app for iPad. He has also traded his skills in the development of technological products for imgura San Francisco-based company that operates an image hosting site.

Serunjogi worked for Facebook in their Dublin office where he was responsible for partnerships with the largest advertisers in the UK market between 2016 and 2018.

Chipper Cash: the birth of a technological revolution in Africa

Despite challenging experiences in their respective businesses, the enthusiasm of the future entrepreneurs for financial technologies and their desire to solve cross-border transfer problems of money in Africa have persisté. Over time, they were able to refine their concept and undertakenendre to launch their solution by founding their own start-up.

So in spring 2018, Serunjogi envoie a text message to Moujaled who worked as a software engineer in San Francisco (at imgur), to tell him that it was time to get started. Putting his money where his mouth is, Serunjogi quits his job and moves into the studio of MoujaledForbes reports. With their $30,000 savings and Moujaledthe two entrepreneurs are launching the test version of ChipperCash the solution for sending free money from Uganda to Ghana, the founders' home country. A few weeks later, they present their test version to several dozen venture capitalists.

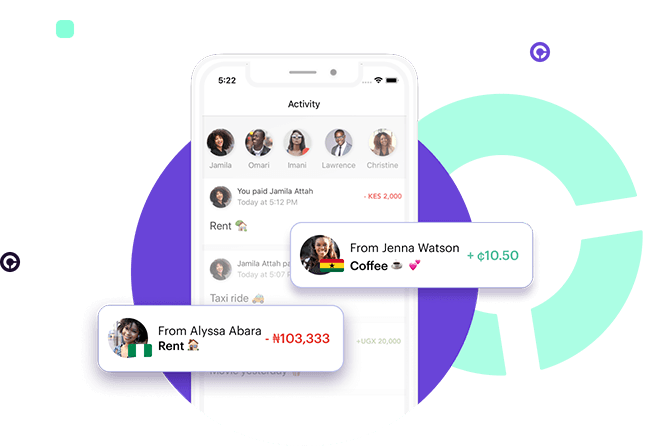

November 2018, 500 startupsan investment fund and start-up incubator, is injecting 150,000 $ into the FinTech based in San Francisco. The following year, the Chipper Cash is available in Uganda, Ghana, Kenya, Rwanda and is rapidly expanding to Nigeria. The same year, in May 2019, startup raises $2.4 million in seed funding at a round table discussion led by Deciens Capital. A few months later, it obtained another $6 million from Deciens Capital and Raptor Group. In 2020, fundraising continues with investors including Ribbit Capital, Bezos Expeditions Jeff's VC Bezos or even Tribe Capital. In 2021, the company will completes a new $100 million Series C funding round and joins the ranks of unicorns. Its transactions reach $200 million in the first quarter of 2021, then $1.6 billion a year later. The free and easy-to-use application has attracted more than 4 million users in just a few years and records 80,000 transactions per day.

From now on, Chipper Cash is present in South Africa and Kenya in addition to the countries mentioned above. Its co-founders, who aimed to solve the problem of intra-African remittances, also dreamed of launching in the United States and thus facilitating remittances from the diaspora to Africa. And they did it in less than 4 years. Indeed, Chipper Cash has expanded to the UK andat United States as part of a strategic global expansion.

The key success factors of the African 100% strike team

When starting a business, it is important to do so with co-founders who complement each other in their skills and share the same vision. And that is, Serunjogi believes in it. Its partnership with Moujaled played an important role in the growth of Chipper Cash and his personal development as a CEO. Indeed, as early as university, his current partner and Chairman of Chipper Cash has been a mentor and a faithful friend. In addition, the ability to Moujaled to develop applications and that of Serunjogi problem-solving and thinking outside the box have helped the duo to meet the challenges and lead their business to success.

Their resilience and strong network have also helped them to cope with challenges. Indeed, regulatory frameworks are different from a African country to the other and it was necessary for the Chipper Cash adapts itself in a way that continues, all by working closely with ecosystem players and regulators. Thus, in just three years, the two entrepreneurs have succeeded in building a a solution for the continent to have access to essential financial services.

Moreover, even if the entrepreneurial duo had to knock on the door of nearly fifty venture capital companies before obtaining their first financing, they were still able to count on a fairly favourable environment to develop their business. Indeed, the fact of having evolved in Silicon Valley may have worked somewhat in the favour of these two technophiles and enabled them to raise several hundred million dollars from ahe list of top VCs.

Since they met during their university studies in the USA, Ham Serunjogi and Maijid Moujaled already knew that together they wanted to create something big and impactful for the benefit of their home continent, Africa. With their skills, perseverance and friendship, they were able to build one of the world's most successful businesses. FinTech the continent's largest, valued at USD 2 billionand all in a very short time. It would seem that the pair have a dream of tackling the cryptocurrencies. Time will tell.