Many people have done it, but few have succeeded in doing it successfully. Ashraf Sabry and Mohamed Okasha are in the latter category. It was in 2008 that the two Egyptians joined forces to create Fawry, a company that develops electronic payment solutions easily adaptable to various terminals. Their main aim was to to solve the problems of slowness, fragmentation and complexity associated with payment procedures in Egypt, in an economy traditionally dominated by cash. With their talent, vision and solid understanding of the market, they were able to meet this challenge effectively and efficiently, and contribute to the ninth UN Sustainable Development Goal : building resilient infrastructure, promoting sustainable industrialisation that benefits all and encouraging innovation. If you have heard of Fawry, you probably don't know who is behind this African unicorn. Fanaka&Co will remedy this.

The faultless career of two experts with complementary profiles

Before co-founding Fawry, Ashraf Sabry had already accumulated more than 20 years of experience in finance and IT. This recognised IT expert spent almost 10 years at IBM as a systems engineer and industry consultant. In 1998, he was appointed to the management ofOratechan Egyptian engineering and manufacturing company for industrial solutions, where he will spend 3 years. In 2001, he joined Raya Holdinga company Egyptian investments which manages a diversified portfolio. Lhe holder of an MBA from Leeds Beckett University in the United Kingdom holds the position of Vice-President and Director of Operations. Thus, for 7 years, Sabry participate largely to the growth of the Groupe in drivingsanThe company has successfully established several companies, developed Raya in the Middle East and was listed on the Egyptian Stock Exchange in 2005. Under his leadership alsoon GThe company was able to increase its turnover to 2 billion Egyptian pounds.

In 2008, Sabry which did not have toso much vocation à to become an entrepreneur realized that that the majority of the population in the regions Middle East and North Africa (MENA) was not banked and hashad notThis is why we have to be careful, access to financial services. In addition, payment procedures were complex and fragmentedes. The idea of a platform omnichannel then starté to germinate in his mind. Also, po set up this solution that would launch the fintech field in Egypt, he a not only decidedé to build on its wealth of experience and technological expertise, but also to surround themselves with the best, starting with collaboratesr with Mohamed Okasha.

The latter, who holds an MBA from the École Supérieure Libre des Sciences Commerciales Appliquées (ESLSCA) in Paris, is an expert in business development and marketing. He has over 18 years of experience in retail, marketing and operations management. He has also been involved in the implementation of various successful initiatives in the information technology and telecommunications sectors.

Indeed, Okasha is a former member of Raya Holding. He spent 10 years in several Gbefore landing at the Direction Gof one of them, the Raya Information Technology. In 2006it a can be found at the telecommunications operator Vodafonewhere he a gs the marketing department before from rally to his future partner in the adventure Fawry. Okasha then becomes Director Gs General Fawry while Sabry is the CEO.

It is therefore armed with their common desire to provide Egyptians with an omnichannel payment gatewaye and secure, and their long experience in running commercial and technological activities, that the two Egyptians embarked on the Fawry adventure.

Two key figures of the fintech ecosystem in Egypt

The Most entrepreneurs start their business almost at the beginning of their career. This was not the case for Okashaand much less for Sabry. They undertook this turnaround much later at the height of their respective careers. They learned to work outside the box, in an environment where the word "fintech" was still unknown. They also had to struggle to meet challenges and prove their concept. " It took us years to get people to buy into it, not just businesses and investors, but consumers too. People would pay their bills via Fawry, then call the call centre to check if the payment had been delivered. " Comment Mohamed Okasha.

But what were the challenges the founders faced when they decided to offer Egypt an electronic payment platform that connects customers and can be usede for different transactions? Sabry explains it very well. He had little time to convince investors that customers would trust à their solution for paying their bills electronically. The main challenge was therefore to launch the business before his personal financial resources were exhausted. This necessarily required a deep understanding of the business model, and sharing of experiences in other markets to convince investors.

To this first challenge was added another no less important one: convince the first issuer of bills, Vodafone in this case, to join the network. However, in the basic Fawry model, the issuer had to allocate financial resources to develop integration with its systems and introduce a new player into its distribution network. Many of the companies approached resisted these conditions. To overcome this obstacle, Sabry made a decision that would prove to be a lifesaver: to take on the cost of implementation and then find a champion (editor's note: Mohamed Okasha) within Vodafone to support it.hold on. He manages to sign Vodafoneis setting up a trade agreementcial attractive to convince customers, recruiting and retaining the right people on his team. Through perseverance, and in the absence of ambitious VCs and startup accelerators, Sabry relied on large institutional investors to support his startup in its early stages.

With Okasha at his side, Sabry continued to invest in a market that everyone said was risky, with a lack of serious investors willing to take risks at an early stage. They have even frôlé bankruptcy but have never stopped to believe in it. Then came the revolution after three years. The two men succeeded in building, through self-sacrifice and resilience, the Egypt's leading digital transformation and electronic payment platform. They are paving the way for other companies and the entire fintech ecosystem in the country.

Founders of the fastest growing company in the Middle East

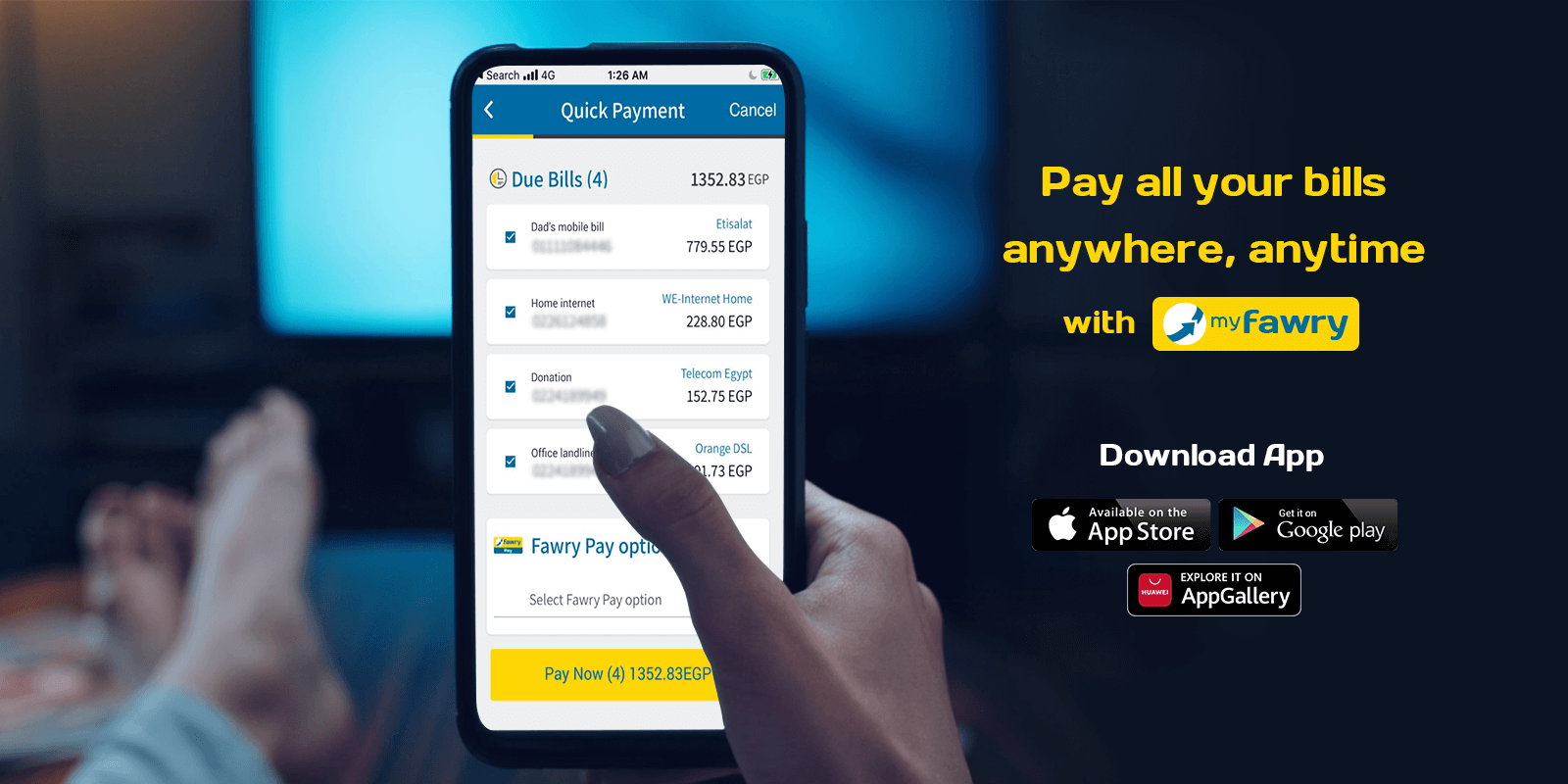

The two partners have developed an active electronic payment platform in the MENA region that can be adapted to both mobile and online wallets, and automated teller machines thatat the point of sale. Fawry has thus become the first electronic payment network in Egypt to pay bills and offer a multitude of financial services to merchants and consumers. Egyptian consumers, both banked and unbanked. Although there were many doubts about their project at the beginning, they were able to build an infrastructure that is accessible through a network of more than 225,000 service points throughout Egypt. To date, Fawry has 29.3 million monthly users and over 3.069 million transactions per day.

As it grows, the company signed an agreement with the Bank National Bank of Egypt and the Misr for the deployment of 60,000 points of sale, in order to d'accept card payments and QR codes as part of the CBE Acceptance initiative. In 2014, just six years after its inception, the company reached $13 million in revenue and served over 15 million customers. And it is notis stopée not there. In August 2019, Fawry was listed on the Egyptian Stock Exchange, which a increases its share price by more than 300 %. On 17 August 2020, one year after the company's IPO, the former Director General, Mohamed Okasha Okasha ad on LinkedIn the entry of the fintech company into the circle of African unicorns. Fawry had just reached the market capitalisation of one billion dollars, thus becoming the first unicorn in Egypt and the third in Africa, after Jumia (whose Africanness is questioned) and Interswitch.

It is worth noting that after 11 years as CEO of Fawry, Mohamed Okasha left the management of the company in April 2020 (he in However, he remains a member of the board of directors) to launch an investment fund, DisrupTech, 25 million, in which IFC has just invested $5 million (March 2022) and which aims to invest in Egyptian fintech startups at different stages.

Convinced that technology is the only solution to the problems related to financial services in Egypt, Ashraf Sabry left his position at Raya Holding to launch the Fawry platform. He came up against many obstacles, particularly related to a new market and a concept that was not yet known in his country. To develop his solution, he was able to count on a strong competence like Mohamed Okasha, a former Raya and Vodafone employee. Between them, they have helped transform the Egyptian economy by reducing dependence on cash, offering lower cost services and a more convenient means of payment. Both entrepreneurs have shown the world that entrepreneurship is more important than age or ownership structure.