Ifê is a Beninese trader who lives in Fidjrossê. She sells mainly loincloths and other fashion accessories. When she wanted to digitalise her business, she encountered a crucial problem: how to get paid? The items were available, and so were the customers. But the customers had less and less time and could not always come to her shop. One day, one of her customers recommended KkiaPay to her.

This solution was unknown to her until then and she was very afraid to channel her business through a solution she knew very little about.

The growing frustration of her customers finally made her decide. With the help of her daughter, she followed all the instructions and installed the application on her website. For those customers who could not use her website, it was now possible to pay directly with a few clicks.

The first transaction went smoothly. So did the fifteenth.

Since then, Ifê has enjoyed managing its sales and monitoring its budget. Understanding the needs of the population and providing a simple, effective and efficient solution is the promise of KkiaPaythe payment aggregator that makes life easier for merchants and their customers. Sellers can finally offer easy and accessible payment methods to all, and customers have a secure payment method that allows them to carry out their transactions without difficulty and from home. Focus on this fintech solution that makes payments possible via all existing local solutions.

KkiaPay: how it works

Created in 2016 by Gilles Kounou, an engineer in the field of IT and founder of OpenSI, a Beninese company that aims to support SMEs in their digital transformation, KkiaPay has become one of Africa's digital champions in a few years. The start-up had to meet a need of the Beninese population: to facilitate payments and other financial transactions by making them accessible to the local population. The existing traditional means of payment and mobile money solutions were not appropriate to meet all the needs. Indeed, a significant part of the Beninese population, unbanked, was unable to make secure purchases/sales of products and services online and at a distance. But thanks to Benin's fintech, customers and merchants can respectively pay and receive payment by mobile money in shops or online.

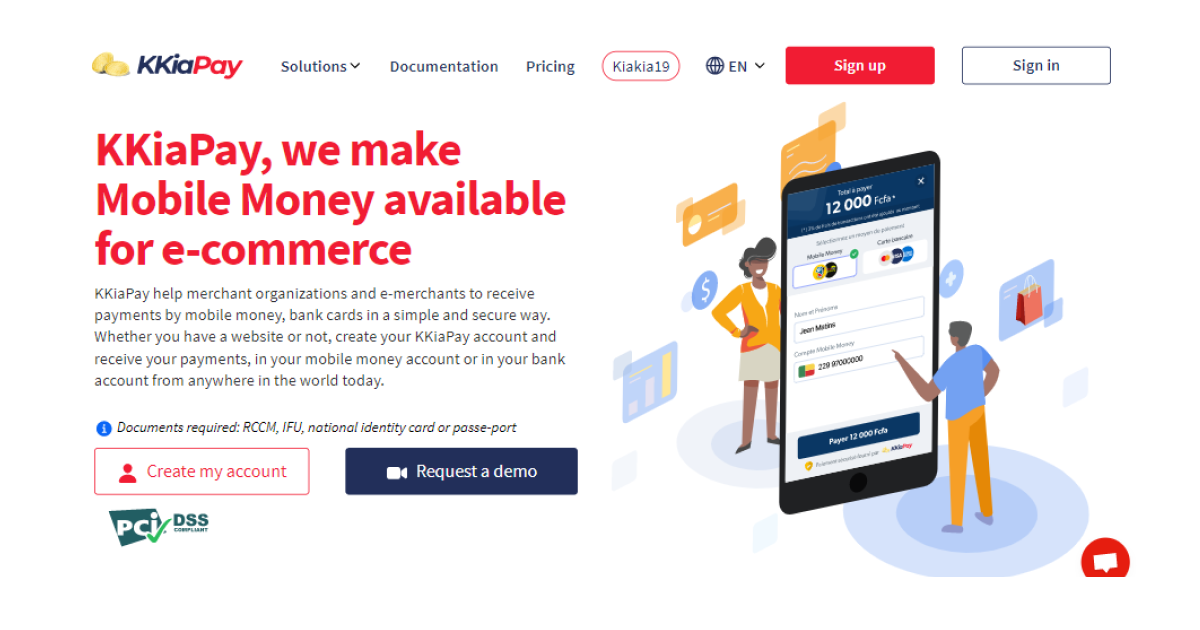

KkiaPay presents itself as the solution for simple remote payment and collection. The way it works is simple. Everything starts with a registration. During the registration process, you will have to provide proof of your identity and your company's registration with a legal organisation. This is a provision that allows KkiaPay to reassure its customers, but also to remain compliant with the jurisdiction.

Once the account has been created, you are provided with an API key that you can easily integrate into your website. If you do not have a website, then a payment link is provided which allows the customer to make a purchase from their Mobile Money account easily.

A booming digital transformation

The world is changing, and with it the different habits. Consumers want to make their purchases simply and without having to go anywhere. The salesperson, on the other hand, is looking for a way to satisfy his customers efficiently and to reach the heart of his target without difficulty. KkiaPay has been able to link these two needs and provide a concrete solution. After 6 years in business, KkiaPay has become an indispensable solution.

Initially available in Benin, the service has conquered many other countries in the sub-region, notably Côte d'Ivoire and Togo, with the long-term vision of establishing it in the various African countries.

KkiaPay or how to build a more accessible world through fintech

With its rapid growth, KkiaPay has spread its wings very quickly. Indeed, the platform has become the reference in all digital financial transactions. With SMEs as its main target, KkiaPay has laid a solid foundation and is now reaching out to various fields. From online passports to online criminal records or even online tax payments, it is now possible to make all kinds of financial transactions effortlessly and easily in Benin.

It is in this spirit that recharges.bj was born, a simple digital solution that allows its users to recharge their electricity meters in a few clicks.

With this solution, recharges.bj puts an end to the frustrations of queuing, wasting time and other problems that made payments difficult.

Since its launch, the payment aggregator has 45,000 transactions per month and over 7,000 merchants.

Gilles Kounou, the founder of KkiaPay

Gilles Kounou has all the makings of a geek. In fact, he is one. Passionate about digital technology, he started coding at the age of 13. With a diploma in avionics from the Marrakech Air Force School and a degree in software engineering, Gilles Kounou is determined to change the perception of Africa on an international level.

Very involved in his community, he developed KkiaPay to solve a persistent problem in this community. In 2015, his efforts were recognised and awarded the Francophone Digital Innovation Prize.

Gilles Kounou is doing his utmost to succeed in the mission he has set himself: to enable people to live easily in the digital age.

Revolutionising the world of financial transactions is the mission of KkiaPay. And the company seems to be in its infancy, and for such a promising start, what follows could only be breathtaking. With its credo of facilitating the customer journey, it is easily winning over the hearts of its users and thus federating a close-knit community. The future of KkiaPay seems to be all set: a story that most people can relate to, a need that is met and a relevant solution.